AlgoForge ORB

Opening Range Breakout strategy with automated entry/exit logic, intelligent reversal handling, and real-time P&L tracking on Nifty 50 Index.

📊 Strategy Logic

The ORB strategy identifies the opening range during the first 5 minutes of market open, then executes trades when price breaks above or below this range. Our implementation includes automatic reversal detection and multi-target exits.

Entry Logic

Buy signal at range breakout with P&L tracker

Reversal Entry Logic

Automatic reversal entry on stop loss hit

📈 Backtest Results

Comprehensive backtesting results from September 2025 to January 2026 on Nifty 50 Index.

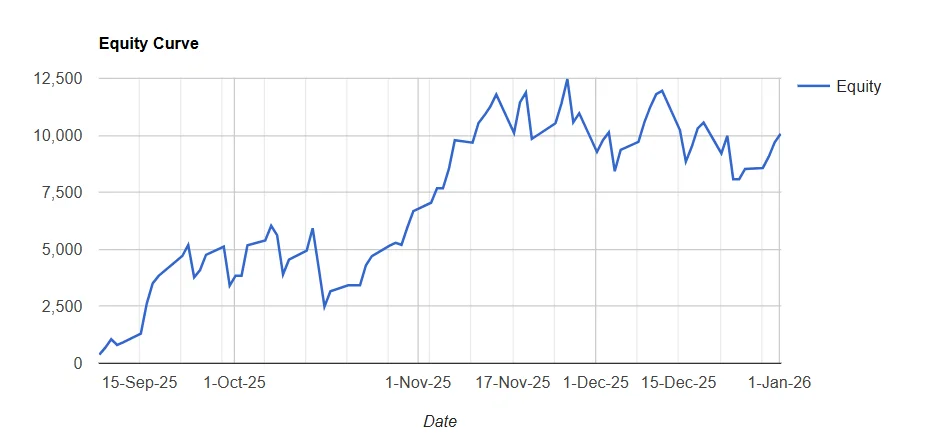

Equity Curve

Consistent growth Sep 2025 - Jan 2026

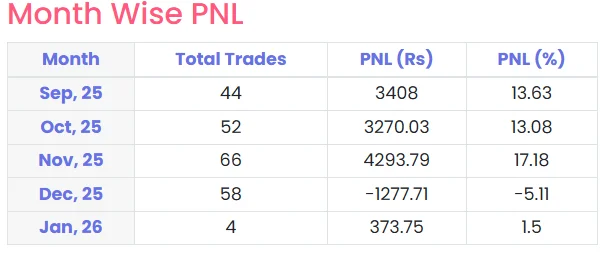

Month Wise P&L

Monthly breakdown of trades and returns

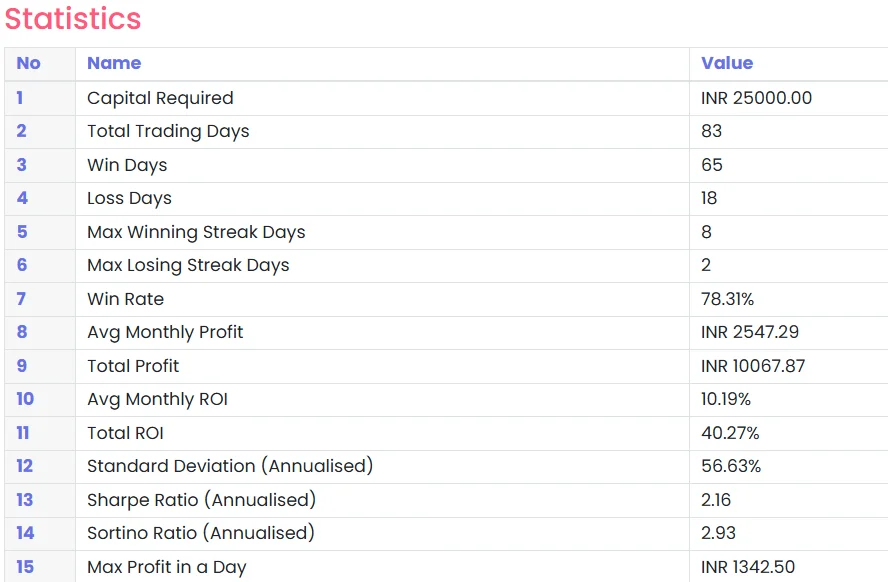

Performance Statistics

Key metrics: Win Rate, ROI, Sharpe Ratio

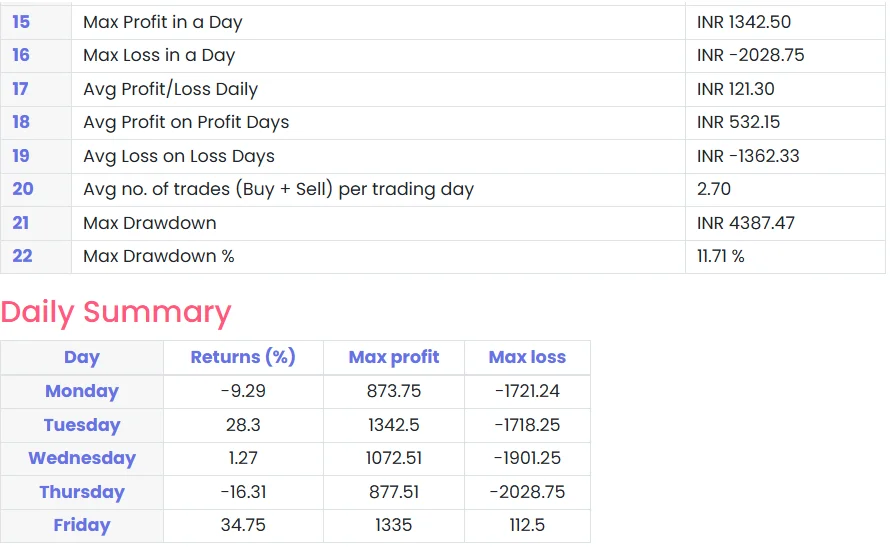

Daily Summary

Day-wise returns analysis

More Strategies

Explore our other algorithmic solutions built with the same logic-first approach.

AlgoForge Volume Scanner

Real-time volume anomaly detection scanner that identifies stocks with unusual volume spikes compared to historical averages.

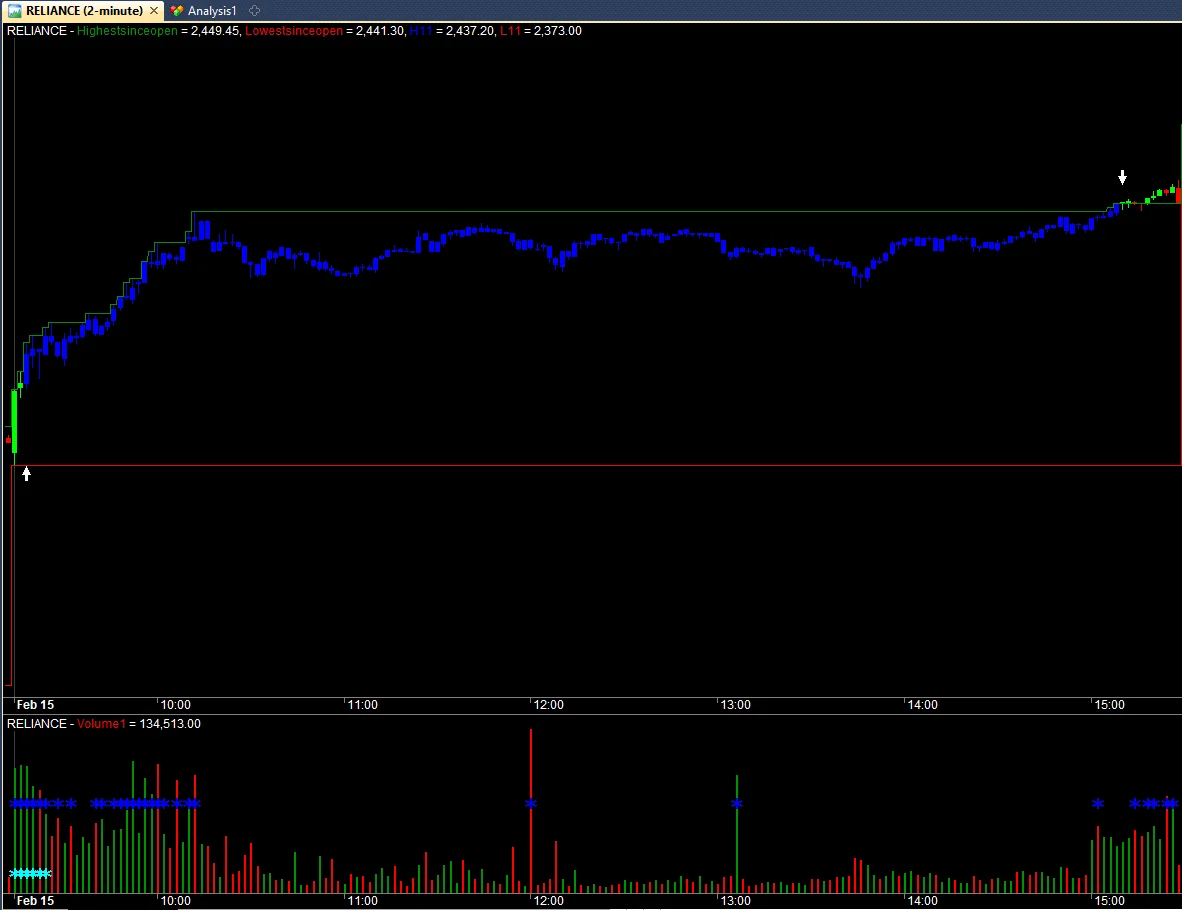

📊 Volume Analysis Charts

Our volume scanner identifies unusual volume patterns in real-time, highlighting potential opportunities based on volume ratio analysis.

Volume Analysis

Real-time volume spike detection with markers

Price Action Analysis

Intraday price movement with volume correlation

📋 Scanner Output

The scanner output table shows stocks with unusual volume activity, color-coded by volume ratio for quick identification.

Live Scanner Output

Color-coded volume ratio alerts with OHLC data

⚡ Execution Options

The Volume Scanner supports multiple execution methods to fit your trading workflow.

📊 Entry & Exit Signals (Visual)

Entry & Exit signals displayed directly on charts with clear visual markers for manual trading decisions.

🔔 Auto Alerts

Real-time notifications when volume anomalies are detected, keeping you informed of opportunities.

🤖 Auto Execution via Broker APIs

Automated order placement through broker integration. Execution requires separate broker authorization and setup.

Interested in Our Strategies?

Get any of these strategies deployed for your trading, or let us develop a custom solution based on your unique logic.

Past performance is based on backtested and live deployed data. Market conditions vary. AlgoForge Tech provides software logic, not financial advice. We build tools for your logic — we are not financial advisers.